LED display screens, known for their efficiency and energy-saving capabilities, have seen widespread adoption globally in recent years. With continuous technological advancements and increasing market demand, the LED display industry is experiencing rapid growth. This report aims to analyze the current market conditions, market share, key LED screen manufacturers and their products, application fields, technological trends, as well as market challenges and opportunities through an in-depth market research of the LED display industry.

Table of Contents:

1. Introduction

2. LED Display Market Trends

3. LED Display Market Share

4. Major LED Display Screen Manufacturers and Their Products

5. LED Screen Application Field Analysis

6. LED Modular Display Market Competitive Landscape

7. LED Screen Technology Development Trends

8. LED Display Market Challenges and Opportunities

9. LED Policy Environment Analysis

10. Supply Chain Analysis

11. Consumer Behavior Analysis

12. Regional Market Analysis

13. Conclusion and Recommendations

14. Reference Reports

1. Introduction

The LED display market is showing a steady growth trend worldwide. China, as the world’s largest producer and consumer of LED displays, shows strong growth momentum.

With the continuous development of LED technology, the brightness, color reproduction, viewing angle and other performance of the display have been significantly improved, further enhancing the advantages of LED displays in display effects. In addition, the manufacturing cost of LED displays has gradually decreased, promoting its widespread application in many fields. Emerging technologies, such as Mini/Micro LED and virtual shooting, have brought new growth points, broadened the market space and promoted technological innovation, providing companies with diversified sources of income.

This has attracted more and more manufacturers to enter this market.

2. LED Display Market Trends

In the last decade, the global LED display market has undergone significant transformation.

2.1 Global LED Display Market Overview

2.1.1 Market Size and Growth Trends

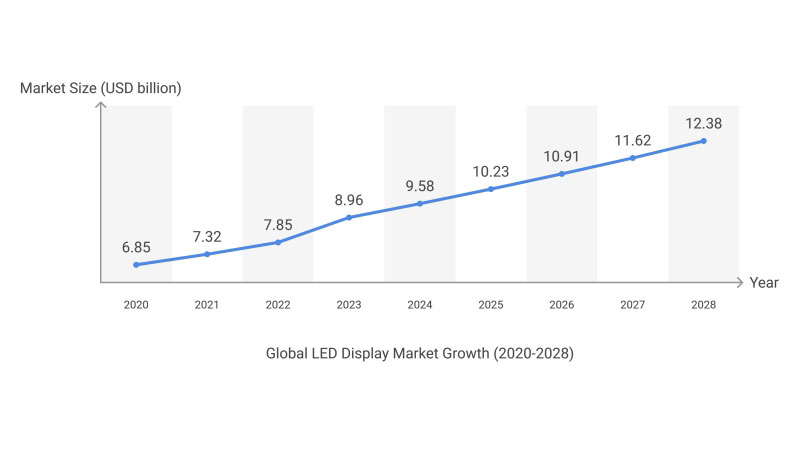

In 2023, the global LED display market reached a size of USD 8.96 billion, marking a 30.8% growth compared to USD 6.85 billion in 2020. By 2028, the market is expected to exceed USD 12 billion, with a compound annual growth rate (CAGR) of approximately 6.5%. This growth is primarily driven by continuous advancements in LED display technology, particularly improvements in brightness, color accuracy, and viewing angles. (Data Source: TrendForce)

2.1.2 Driving Factors

Technological Advancements: New technologies such as Mini/Micro LED and Chip on Board (COB) have significantly enhanced the resolution, brightness, and color performance of LED displays.

Cost Reduction: With large-scale production and improved manufacturing processes, the production cost of LED displays has been decreasing year by year, facilitating market adoption.

Expansion of Application Fields: LED displays have gradually expanded from traditional outdoor advertising and sports venues to emerging fields such as virtual filming, smart cities, and retail displays.

2.2 China LED Display Market Overview

2.2.1 LED Display Market Size and Growth Trends

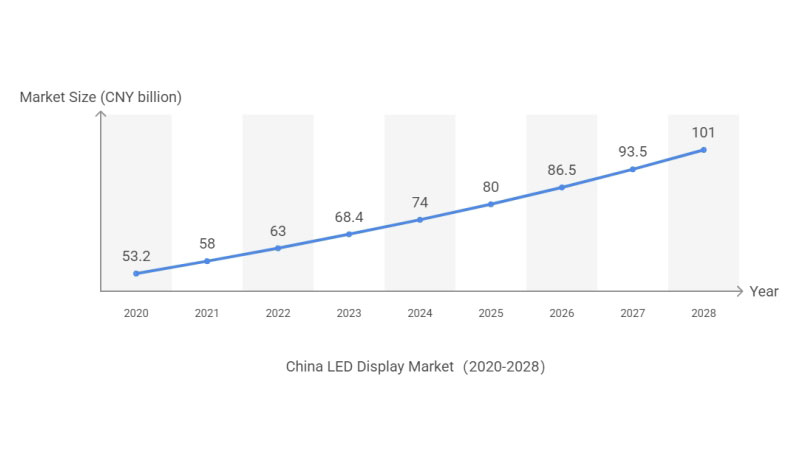

As the largest producer and consumer of LED display screens globally, China’s market size grew from CNY 53.2 billion in 2020 to CNY 68.4 billion in 2023, with a CAGR of around 8.7%. By 2028, the market size in China is projected to exceed CNY 100 billion. (Data Source: China LED Display Industry Association)

2.2.2 LED Display Market Characteristics

Technological Leadership: Chinese companies lead the global market in areas like small-pitch LEDs and Mini/Micro LEDs.

Strong Exports: China accounts for over 60% of the global LED display exports, with major export destinations including North America, Europe, and Southeast Asia.

Policy Support: The Chinese government strongly supports the LED industry through tax incentives, R&D subsidies, and other favorable policies.

2.3 Technology Development Trends

2.3.1 Mini/Micro LED Technology

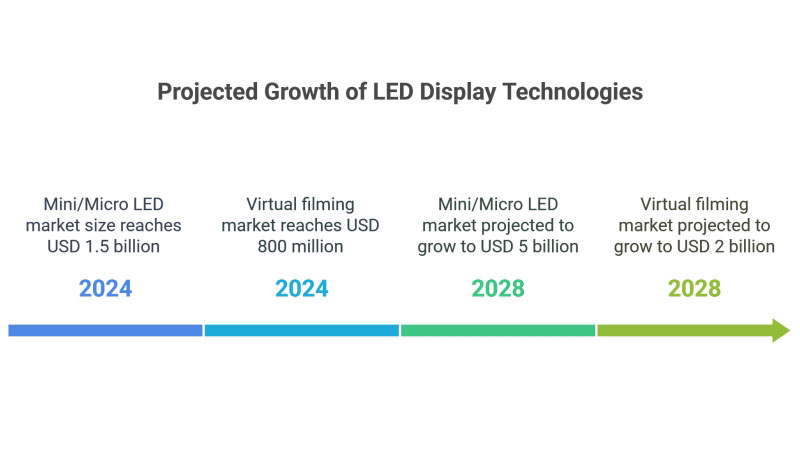

Mini/Micro LED technology is a key development direction for the LED display industry. Compared to traditional LED displays, Mini/Micro LEDs offer higher resolution, lower power consumption, and longer lifespan. In 2023, the Mini/Micro LED market size reached USD 1.5 billion, and it is expected to grow to USD 5 billion by 2028. (Data Source: Omdia)

2.3.2 Virtual Filming Technology

Virtual filming technology is an important application of LED screen displays in the film and television production industry. By using high-resolution, high-brightness LED displays, film production can achieve more realistic visual effects while reducing post-production costs. In 2023, the virtual filming market reached USD 800 million, and it is expected to grow to USD 2 billion by 2028. (Data Source: Frost & Sullivan)

2.3.3 Smart Control Systems

Smart control systems are a crucial component of LED display technology. With these systems, users can remotely control LED displays, manage content, diagnose faults, and more, enhancing operational efficiency and ease of maintenance.

3. LED Display Market Share

The global LED display market is characterized by a diverse range of applications and geographic dynamics.

3.1 Global Market Share

3.1.1 Global Display Market Structure

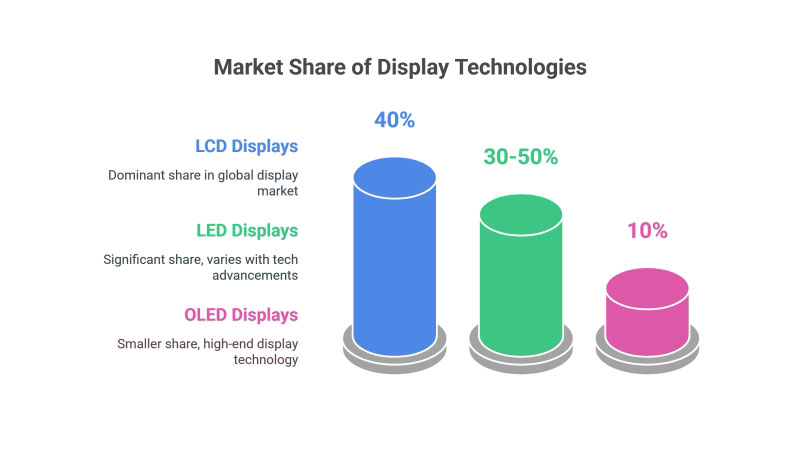

In the global display market, LED displays account for 30% to 50% of the market share, with the specific proportion changing according to technological advancements and market development. LCD displays and OLED displays occupy 40% and 10% of the market share, respectively. (Data Source: DSCC)

3.1.2 LED Display Application Field Share

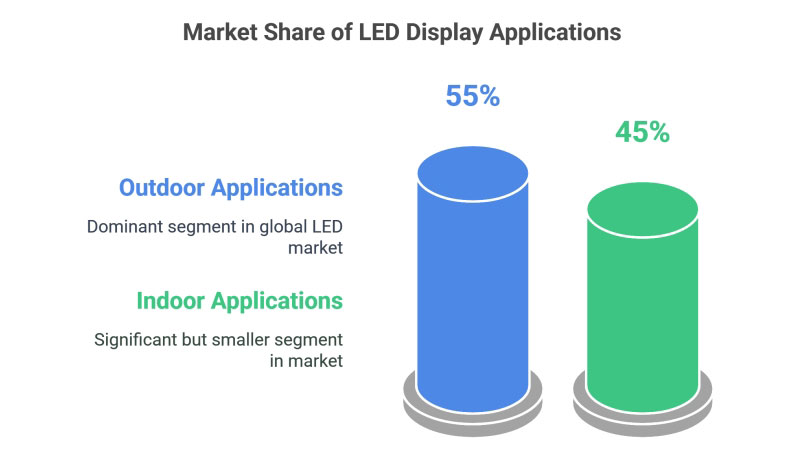

In the global LED display market, outdoor applications account for 55%, while indoor applications account for 45%.

3.2 China Market Share

3.2.1 China LED Display Market Structure

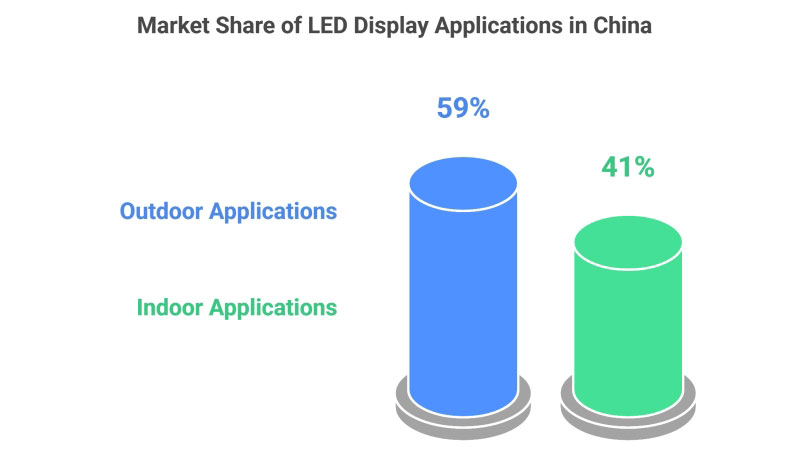

In the Chinese LED display market, outdoor applications account for 59%, while indoor applications account for 41%. (Data Source: China LED Display Industry Association)

3.2.2 Main Application Fields

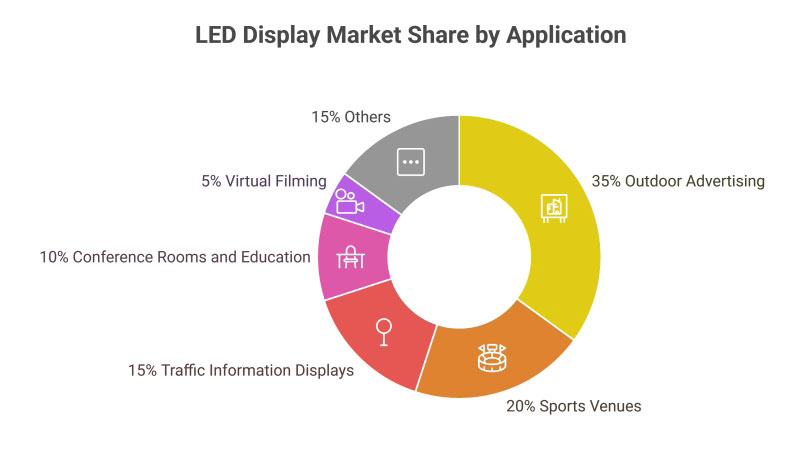

Outdoor Advertising: 35%, the main application area for LED displays.

Sports Venues: 20%, mainly for live event broadcasts and advertising displays.

Traffic Information Displays: 15%, widely used in highways and urban traffic.

Conference Rooms and Education: 10%, small-pitch LED displays are gradually replacing traditional projectors.

Virtual Filming: 5%, an emerging field with rapid growth.

(Data Source: China LED Display Industry Association)

3.3 Regional Market Share

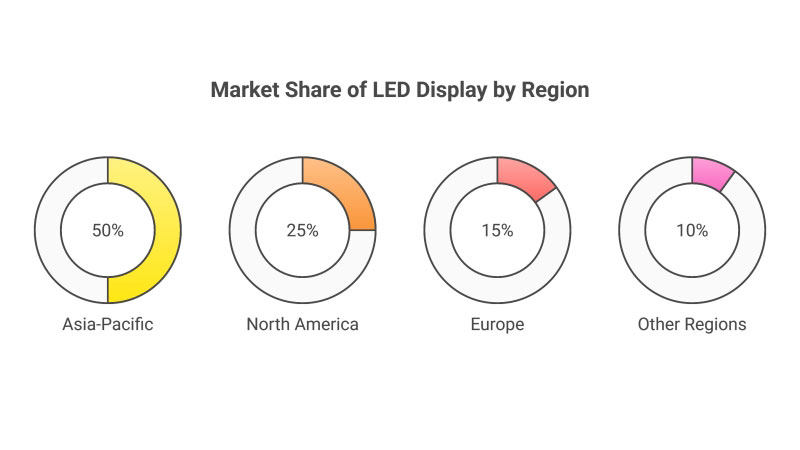

Asia-Pacific Region: 50%, the largest LED display market globally, mainly driven by strong growth in China.

North America: 25%, primarily used in outdoor advertising and sports venues.

Europe: 15%, with high environmental standards driving the development of green LED technology.

Other Regions: 10%, including emerging markets in the Middle East, Africa, and others.

(Data Source: Statista)

4. Major LED Display Screen Manufacturers and Their Products

The LED display market features many key players, each contributing to market growth with innovative products.

4.1 Domestic Top 10 LED Screen Manufacturers in World

4.1.1 Leyard

Company Overview:

Leyard, founded in 1995 and headquartered in Beijing, is a global leader in visual technology products and cultural applications. The company specializes in LED display technology R&D and innovation and is one of the leading companies in the global LED display industry. Leyard has maintained the largest market share for seven consecutive years, especially dominating the indoor small-pitch LED display sector.

Company Achievements:

In 2012, Leyard successfully developed the world’s first small-pitch LED display, marking a new era in LED display technology.

In 2016, Leyard became the number one global market share holder for LED displays and has maintained this position ever since.

In 2020, Leyard achieved a major breakthrough in virtual filming, providing LED display solutions for several Hollywood films.

Main Products: Small-Pitch LED Displays, Virtual Filming LED Screens, LED TV.

4.1.2 Unilumin

Company Overview:

Founded in 2004 and headquartered in Shenzhen, Unilumin is a global leader in LED applications and solutions. The company holds more than 320 valid patents and focuses on LED display technology R&D and innovation, with products sold in over 100 countries and regions worldwide.

Company Achievements:

In 2018, Unilumin launched the world’s first Mini LED display, leading industry innovation.

In 2021, Unilumin became the main supplier of LED display systems for the Beijing Winter Olympics.

In 2023, Unilumin made breakthroughs in smart city technology, launching several smart LED display products.

Main Products: Outdoor Full-Color LED Displays, Mini LED Displays, Smart City Solutions.

4.1.3 Lopu

Company Overview:

Founded in 1991 and headquartered in Nanjing, Lopu is one of the earliest institutions in China to develop and produce large LED displays. The company specializes in the research of core LED display technologies, with products widely used in transportation, energy, security, and other fields.

Company Achievements:

In 1995, Lopu developed China’s first full-color LED display, filling the domestic technology gap.

In 2010, Lopu became a major supplier of LED display systems for the Shanghai Expo.

In 2022, Lopu achieved major breakthroughs in traffic information display, providing smart traffic display solutions for multiple cities.

Main Products: Traffic Information Display Systems, Security Monitoring Display Systems, Smart Engineering Solutions.

4.1.4 Retop

Company Overview:

Founded in 2003 and headquartered in Shenzhen, Retop specializes in providing customized LED application products and solutions for professional markets such as advertising, sports venues, and large events. The company is known for its innovative design and high-quality products, with products sold in over 80 countries and regions worldwide.

Company Achievements:

In 2015, Retop became a major supplier of LED display systems for the Brazil World Cup.

In 2019, Retop launched the world’s first transparent LED display, leading industry innovation.

In 2023, Retop achieved breakthroughs in large events, providing LED display solutions for multiple international events.

Main Products: Transparent LED Displays, Sports Venue LED Displays, Large Event LED Solutions.

4.1.5 LianTronics

Company Overview:

Founded in 2003 and headquartered in Shenzhen, LianTronics is a comprehensive enterprise engaged in LED display systems, outdoor advertising operations, and digital media integration. The company is known for its technological innovations and high-quality products, with global sales across over 100 countries and regions.

Company Achievements:

In 2010, LianTronics became a major supplier of LED display systems for the Guangzhou Asian Games.

In 2018, LianTronics launched the world’s first integrated meeting system, leading technological innovation in the industry.

In 2022, LianTronics achieved breakthroughs in digital media, providing smart advertising solutions for cities.

Main Products: Integrated Meeting Systems, Outdoor Advertising Screens, Digital Media Solutions.

4.1.6 Absen

Company Overview:

Absen, founded in 2001 and headquartered in Shenzhen, is a leading global provider of LED displays and services. The company’s products are sold in over 120 countries and regions, with more than 30,000 projects implemented.

Company Achievements:

In 2014, Absen became a major supplier of LED display systems for the Brazil World Cup.

In 2019, Absen launched the world’s first transparent LED display, leading technological advancements in the industry.

In 2023, Absen achieved breakthroughs in virtual filming, providing LED display solutions for several Hollywood films.

Main Products: Stage Rental LED Screens, Transparent LED Displays, Virtual Filming LED Screens.

4.1.7 Ledman

Company Overview:

Ledman, founded in 2004 and headquartered in Shenzhen, is a specialist in ultra-high-definition LED displays. The company operates large-scale manufacturing bases equipped with advanced optoelectronic production equipment and is dedicated to maintaining leadership in the high-end LED sector.

Company Achievements:

In 2016, Ledman became the key supplier of LED display systems for the Chinese Super League.

In 2020, Ledman launched the world’s first Micro LED display, leading industry technological innovation.

In 2023, Ledman achieved breakthroughs in smart city solutions, providing intelligent LED display systems for multiple cities.

Main Products: Micro LED Displays, Smart City Solutions, High-End LED Displays.

4.1.8 Sansi

Company Overview:

Sansi, founded in 1993 and headquartered in Shanghai, is a leading provider of LED display and lighting solutions in China. The company holds 310 patent applications and 224 authorized patents, focusing on LED display technology research and innovation.

Company Achievements:

In 2010, Sansi became a key supplier of LED display systems for the Shanghai World Expo.

In 2018, Sansi launched the world’s first smart streetlight, leading innovation in the industry.

In 2023, Sansi made breakthroughs in smart city solutions, providing intelligent LED display systems for cities.

Main Products: Smart Streetlights, Smart City Solutions, LED Displays.

4.1.9 AOTO

Company Overview:

AOTO was founded in 2001 and is headquartered in Shenzhen. It is a global leader in LED display products and solutions. The company is renowned for its innovative designs and high-quality products, with its products sold in over 80 countries and regions worldwide.

Company Achievements:

In 2015, AOTO became the main supplier of LED display systems for the Brazil World Cup.

In 2019, AOTO launched the world’s first virtual production LED screen, leading technological innovation in the industry.

In 2023, AOTO made a breakthrough in augmented reality, providing LED display solutions for several international events.

Main Products: Virtual Production LED Screen, Augmented Reality LED Screen, Creative LED Screen.

4.1.10 LedInCloud

Company Overview:

LedInCloud is a leading LED video wall manufacturer with 15 years of expertise in the development and production of high-quality LED displays. Their LED control systems meet CE, EMC-B, FCC, and RoHS standards, ensuring top-tier performance and reliability.

Main Products: LED Screen Cloud Platform, Outdoor LED Wall Screen, Indoor Fixed LED Displays, LED Video Wall Rentals.

4.2 Foreign Leading LED Screen Manufacturers and Major Products

4.2.1 Daktronics

Company Overview:

Daktronics was founded in 1968 and is headquartered in South Dakota, USA. It is a global leader in LED display technologies and solutions, focusing on products for sports venues, traffic information displays, and other sectors.

Main Products:

Sports Venue LED Displays: High brightness and refresh rate, suitable for live sports events and advertising.

Traffic Information Display Systems: High reliability, widely used in highways and urban traffic systems.

4.2.2 Samsung

Company Overview:

Samsung is a global leader in electronic product manufacturing, headquartered in Seoul, South Korea. The company has strong technical capabilities and innovation in the field of LED display technologies.

Main Products:

Micro LED Transparent Screens: High light transmittance and clarity, suitable for high-end commercial display scenarios.

The Wall Integrated LED Screens: Ultra-high-definition, modular design, suitable for high-end meeting rooms, home theaters, and other settings.

4.2.3 LG

Company Overview:

LG is a global leader in electronic product manufacturing, headquartered in Seoul, South Korea. The company has strong technical capabilities and innovation in the field of LED display technologies.

Main Products:

LED Transparent Screens: High light transmittance and clarity, suitable for mall windows, stage backgrounds, and other venues.

Outdoor Advertising Screens: High brightness and reliability, widely used in urban advertising and commercial displays.

4.3 Comparison Table of Top LED Screen Manufacturers

| Company (Country/Region) | Core Products & Technologies | Market Positioning |

| Leyard (China) | Small-pitch LED, virtual production screens, full-color displays | Global market share leader (11.4%) |

| Unilumin (China) | MiniLED displays, smart city solutions | Global market share (10.9%) |

| Liantronics (China) | High-cost-performance indoor/outdoor displays, standardized modules | Leader in mass-market segments (10.2%) |

| Absen (China) | Transparent screens, stage rental displays, conference all-in-ones | Export leader (120 countries) |

| Samsung (Korea) | The Wall (MicroLED) | Benchmark for high-end display tech |

| LG (Korea) | LED cinema screens, ultra-small-pitch products (P0.9) | Full-scenario solution provider |

| Barco (Belgium) | Virtual production screens, medical-grade precision displays | Leader in professional visualization |

| Daktronics (USA) | Stadium scoreboards, traffic info screens | Expert in sports and public services |

4.4 Comparison Table of Technical Advantages

| Technology Field | Leading Companies | Technical Features |

| Small-pitch LED | Leyard, Unilumin | P0.9, P0.7 ultra-high-definition displays, suitable for high-end meeting rooms and command centers |

| Mini/Micro LED | Unilumin, Leyman, Samsung | P0.6, P0.7 ultra-high-definition displays, suitable for high-end commercial and home theater applications |

| Virtual Production | Leyard, Absen, AOTO | High brightness, high resolution, supports real-time rendering and virtual scene filming |

| Transparent LED | Retop, Absen, LG | High light transmittance, high clarity, suitable for storefront windows and stage backgrounds |

| Smart City | Unilumin, Leyman, Sansi | Integrates LED displays with IoT technology, providing smart city management solutions |

| Stadium Displays | Retop, Daktronics | High brightness, high refresh rate, suitable for live sports broadcasting and advertising |

| Outdoor Advertising | Liantronics, LG | High brightness, high reliability, suitable for urban advertising and commercial displays |

| Conference All-in-One | Liantronics | Integrates LED displays with conference systems, suitable for high-end meeting rooms and command centers |

| Stage Rental Displays | Absen | Lightweight, easy installation, suitable for concerts, exhibitions, and large events |

| Smart Streetlights | Sansi | Integrates LED displays with smart lighting systems, suitable for urban roads and parks |

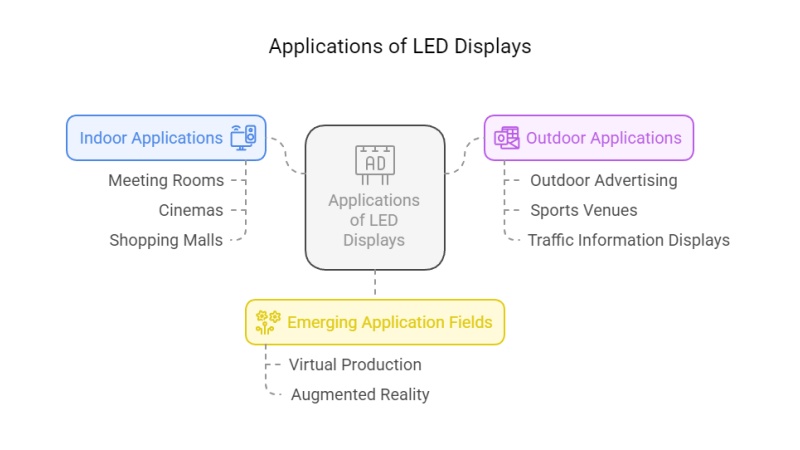

5. LED Screen Application Field Analysis

LED displays are widely used in various sectors. Major application fields include:

5.1 Indoor Applications

Indoor LED displays primarily include meeting rooms, cinemas, shopping malls, and other venues. With the maturation of fine-pitch LED technology, the resolution and display performance of indoor LED displays have significantly improved, gradually replacing traditional LCD displays.

5.2 Outdoor Applications

Outdoor LED display screens, widely used in outdoor advertising, sports venues, traffic information displays, and other fields. Outdoor LED displays need to possess high brightness, waterproofing, dustproofing, and other features to adapt to complex environmental conditions.

5.3 Emerging Application Fields

With technological advancements, LED screen displays are increasingly used in emerging fields such as virtual production and augmented reality. For example, the application of Mini/Micro LED technology in virtual production provides more realistic visual effects for film and television production.

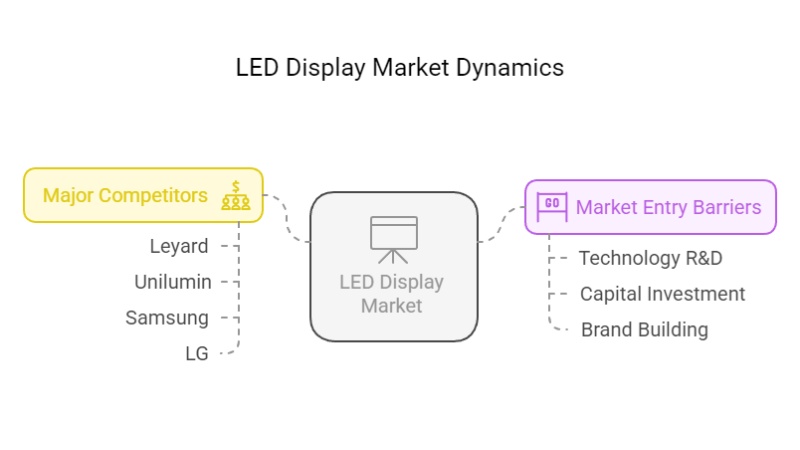

6. LED Modular Display Market Competitive Landscape

6.1 Major Competitors Analysis

The global LED display market is highly competitive, with major competitors including LedInCloud, Leyard, Samsung, LG, and others. These companies have significant advantages in technology research and development, market expansion, and brand influence.

6.2 Market Entry Barriers

The barriers to entry in the LED display industry are high, primarily in areas such as technology research and development, capital investment, and brand building. New entrants need strong technological R&D capabilities and financial backing to establish themselves in a competitive market.

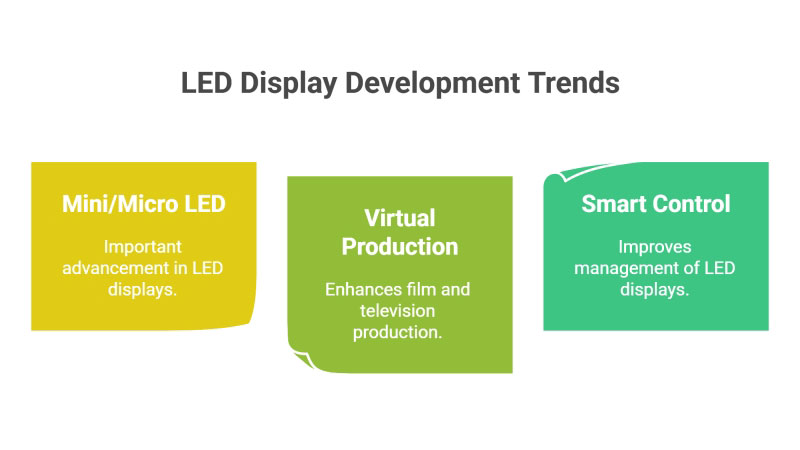

7. LED Screen Technology Development Trends

Mini/Micro LED Technology

Mini/Micro LED technology is an important development direction for the LED display industry. Compared to traditional LED displays, Mini/Micro LEDs offer higher resolution, lower power consumption, and longer lifespan, and are widely used in high-end display applications.

Virtual Production Technology

Virtual production technology is a key application of LED displays in film and television production. By using high-resolution and high-brightness LED displays, virtual production enables more realistic visual effects, reducing post-production costs.

Smart Control Systems

Smart control systems are an important part of LED display technology. Through intelligent control systems, users can remotely control LED displays, manage content, diagnose faults, and perform other functions, improving operational efficiency and maintenance convenience.

8. LED Display Market Challenges and Opportunities

8.1 Market Challenges

High technological threshold: The LED display industry experiences rapid technological advancements, and companies must continuously invest in research and development to maintain their competitive edge.

Intense market competition: The global LED display market is highly competitive, with frequent price wars, putting pressure on profit margins for companies.

Increasing environmental requirements: With the growing stringency of environmental regulations, LED display companies must focus more on environmentally friendly production, raising production costs.

8.2 Market Opportunities

Emerging application fields: Emerging fields like virtual production and augmented reality provide new growth opportunities for the LED display industry.

Expansion into international markets: With the global market expanding, LED display companies can increase revenue by entering new international markets.

Technological progress: The application of new technologies such as Mini/Micro LED presents new development opportunities for the LED display industry.

9. LED Policy Environment Analysis

Government policies play a key role in shaping the LED display market.

9.1 Domestic Policies

(1) “Made in China 2025”

Policy Content: The plan advocates for the transformation of manufacturing into intelligent, green, and service-oriented industries, supporting the application of LED displays in smart manufacturing and smart transportation.

Impact Analysis: This policy encourages companies to enhance production automation, reduce energy consumption, and promote the application of LED displays in Industry 4.0.

(2) Shenzhen’s “Measures to Support the Development of the LED Industry”

Policy Content: Provides R&D subsidies, tax incentives, and talent recruitment support to LED display companies.

Impact Analysis: As a core region for China’s LED display industry, Shenzhen’s policies further strengthen its industrial advantage.

9.2 International Policies

(1) “European Green Deal”

Policy Content: The EU aims to achieve carbon neutrality by 2050 and promotes the use of green technologies and energy-saving products.

Impact Analysis: LED displays, as energy-saving products, will see increased demand in the European market.

(2) “Infrastructure Investment and Jobs Act”

Policy Content: Invests $1.2 trillion in infrastructure construction, including smart cities and traffic information display systems.

Impact Analysis: The application of LED displays in smart transportation and outdoor advertising will be further expanded.

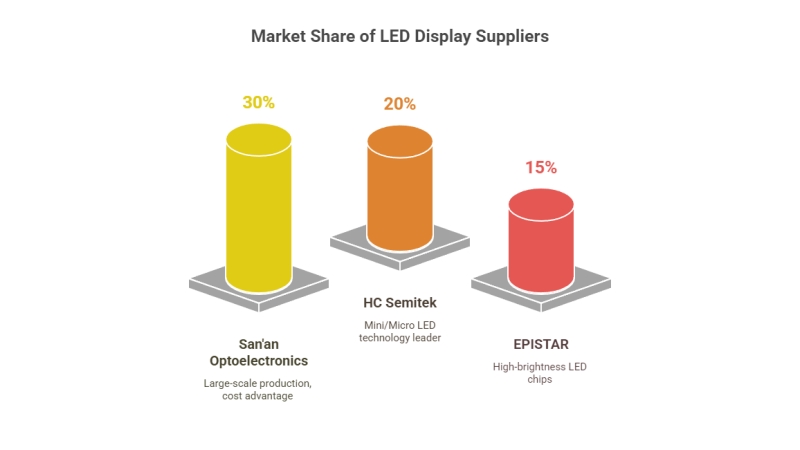

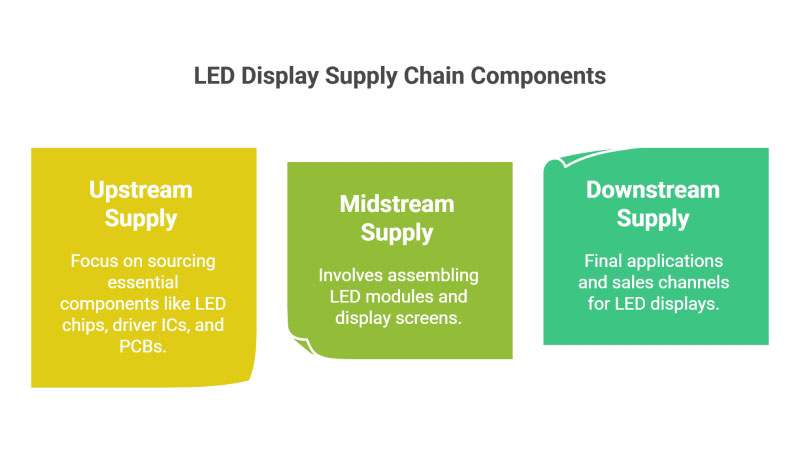

10. Supply Chain Analysis

10.1 Upstream Supply Chain

(1) LED Chips

LED chips are the core components of LED displays. Key suppliers include:

San’an Optoelectronics: The largest global LED chip manufacturer with a market share of over 30%.

HC Semitek: Focuses on high-end LED chip development, especially with technological advantages in Mini/Micro LED.

(2) Driver ICs

Driver ICs are used to control the brightness and color of LED displays. Key suppliers include:

Macroblock: A global leader in LED driver ICs, with a market share exceeding 40%.

Mindspeed Technologies: Focuses on small-pitch LED driver ICs with leading-edge technology.

(3) PCBs (Printed Circuit Boards)

PCBs are a fundamental component in LED displays. Key suppliers include:

Shennan Circuits: A leading PCB manufacturer in China, specializing in high-end LED display PCBs.

Unimicron Technology: Known for its technological advantage in multi-layer PCBs.

10.2 Midstream Supply Chain

(1) LED Display Modules

LED display modules are the core components of LED displays. Major manufacturers include:

Leyard: A leading global supplier of LED modules, with a market share exceeding 20%.

Unilumin: Focuses on high-end LED module development with leading technology.

(2) LED Screen Assembly

LED screen assembly companies integrate LED modules, driver ICs, and other components into complete LED displays. Key companies include:

LianTronics: A leading domestic LED display assembly company, with products widely used in outdoor advertising and sports venues.

Absen: Specializes in high-end LED display assembly with leading technology.

10.3 Downstream Supply Chain

(1) End-User Application Fields

LED displays have a broad range of downstream applications, including:

Outdoor Advertising: 35% of the market, being the main application area for LED displays.

Sports Stadium LED Screen: 20% of the market, primarily for event live broadcasting and advertising.

Smart Cities: 15% of the market, used for traffic information displays, security monitoring, and more.

(2) Sales Channels

The sales channels for LED displays include:

Direct Sales: Large enterprises (such as Leyard, Unilumin, LedInCloud) provide direct sales services to major clients.

Distributors: Small and medium-sized enterprises expand their market reach through distributors.

E-commerce Platforms: Some companies sell standardized products through e-commerce platforms.

11. Consumer Behavior Analysis

11.1 Changes in Consumer Demand

As consumer demands for display quality increase, characteristics such as high resolution, high brightness, and low power consumption are becoming increasingly favored.

11.2 Consumer Preference Analysis

When selecting LED displays, consumers are increasingly focusing on brand, quality, and service, with price no longer being the only determining factor.

12. Regional Market Analysis

North American Market:

The North American market is one of the key global markets for LED displays, mainly applied in outdoor advertising and sports venues.

European Market:

The European market has higher environmental requirements for LED displays, driving the green development of LED display technology.

Asia-Pacific Market:

The Asia-Pacific market is the largest global market for LED displays, with China accounting for a significant share of the global market.

Other Regional Markets:

Other regions, such as the Middle East and Africa, are gradually increasing their use of LED displays, with significant market potential.

13. Conclusion and Recommendations

The LED display industry is experiencing steady global growth, especially driven by the Chinese market, with broad prospects. However, companies must face challenges such as high technological barriers and intense market competition. It is recommended that companies increase investment in technological research and development, explore emerging application fields, and enhance brand influence to stand out in the competitive market.

14. Reference Reports

(1) China LED Display Industry Association. (2023). China LED Display Market Report.

(2) Zhongyan Puhua. (2025). Analysis of the LED Industry Status and Development Trends in 2025.

(3) TrendForce. (2024). 2025 Global LED Display Market Report.

(4) Business Research Insights. (2025). LED Display Market Size Forecast.

(5) TrendForce. (2024). LED Display Price and Cost Analysis.

(6) Zhongshang Business Intelligence Network. (2023). LED Display Competitive Landscape Forecast.

(7) Zhongyan Puhua. (2025). LED Display Industry Chain Structure.